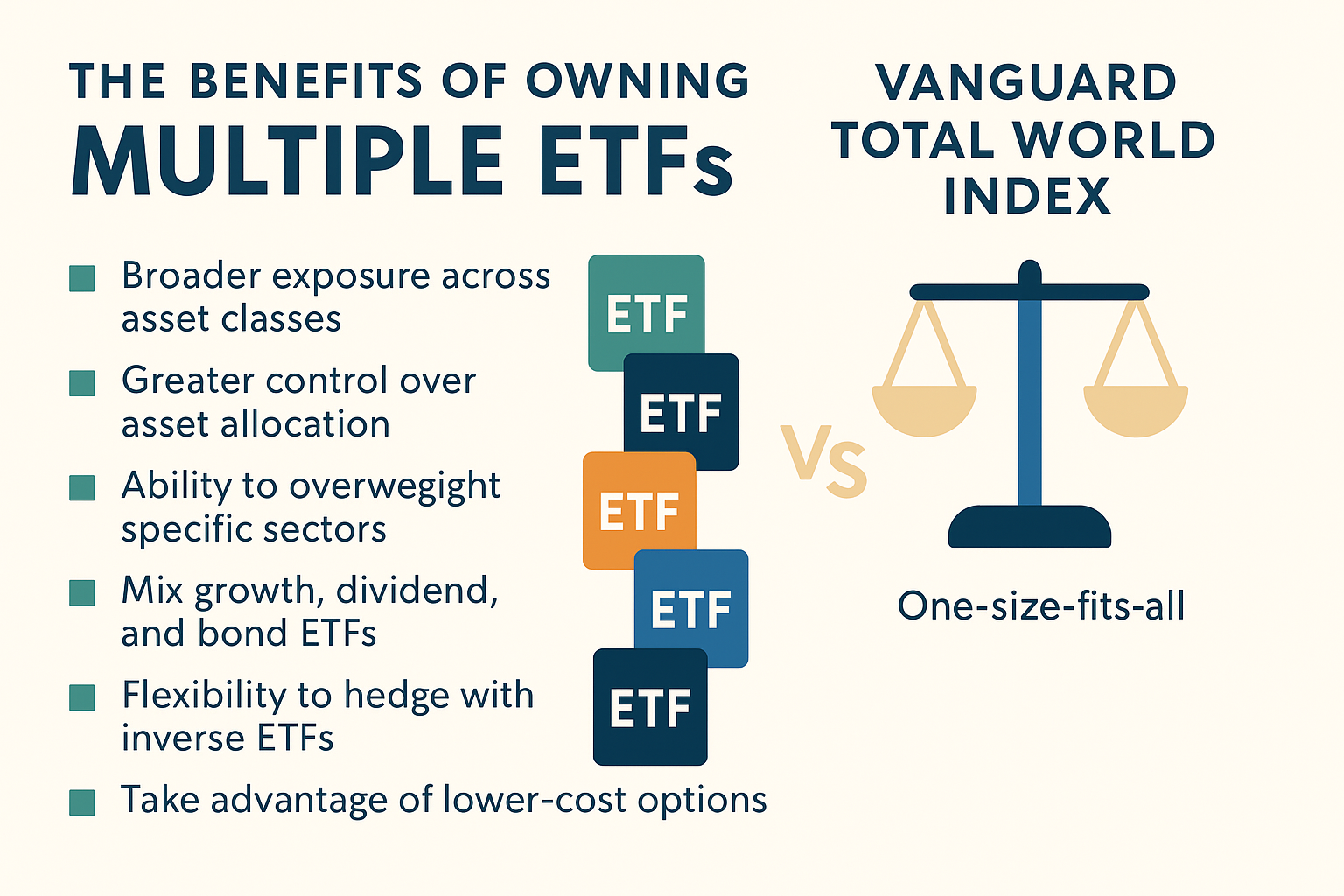

Vanguard’s Total World Stock ETF (VT) is often praised as the ultimate “set it and forget it” solution — and for good reason. It offers global exposure in one simple trade. But if you’re serious about optimizing your portfolio, it’s time to go beyond VT.

Owning multiple ETFs allows you to take control, fine-tune your allocation, and actually build a portfolio that works for your goals — not just the average investor’s.

💥 Why “One ETF to Rule Them All” Falls Short

VT is great for:

- Simplicity

- Broad exposure

- Low fees

But here’s the truth: VT gives you zero flexibility.

- You’re locked into market cap weightings (i.e., top-heavy in U.S. tech)

- You can’t overweight high performers

- You can’t hedge during downturns

- And you can’t diversify across asset types (like bonds, commodities, or dividends)

🔑 The Case for Owning Multiple ETFs

1. Broader Exposure Across Asset Classes

By holding multiple ETFs, you can layer in:

- U.S. stocks (SCHD, VTI, QQQ)

- International stocks (VXUS, VEA)

- Dividend plays (DGRO, JEPI)

- Bonds (BND, AGG, TLT)

- Commodities (DBC, COMT)

- Real estate (VNQ)

2. Greater Control Over Allocation

Want more international exposure? Overweight SCHY. Want tech alpha? Stack QQQ.

Multiple ETFs = custom risk-adjusted allocation.

3. Strategic Overweighting

ETFs let you overweight sectors you believe in:

- Semiconductors? SMH

- Healthcare? XLV

- Energy? XLE

This flexibility is impossible with VT.

4. Better Yield Opportunities

Income-focused ETFs like SCHD or VYM give you higher dividends than what VT delivers. That’s real cash flow, not just paper gains.

5. Flexibility to Hedge

With inverse ETFs like BITI or SARK, you can protect your portfolio during downturns. VT doesn’t give you that safety valve.

6. Lower Cost Through Selectivity

Some ETFs offer lower expense ratios or more tax-efficient structures. You can optimize fees by selectively owning instead of going all-in on VT.

🧠 Build a “Stacked” ETF Portfolio

Here’s a sample diversified ETF stack:

| Category | ETF | Allocation |

|---|---|---|

| U.S. Total Market | VTI | 25% |

| Dividend Income | SCHD | 15% |

| International Stocks | VXUS | 15% |

| Bonds | BND | 10% |

| Commodities | DBC | 5% |

| Real Estate | VNQ | 5% |

| Tech Growth | QQQ | 15% |

| Hedge | BITI / SARK | 10% |

This isn’t just diversified — it’s strategic.

🚫 Why VT Alone = Lazy Diversification

It’s not that VT is bad — it’s just basic. If you’re building serious wealth, you want stacked layers of performance, income, and protection.

Conclusion:

Owning multiple ETFs gives you true diversification, targeted returns, and the ability to adapt. VT is fine if you want to set it and forget it — but if you want to win, stack your ETFs like a pro.

The world of investing isn’t one-size-fits-all.

Your portfolio shouldn’t be either.

Disclaimers:

This article is for informational purposes only and is not financial advice. Always consult a certified financial advisor before making investment decisions.

As an Amazon Associate, I earn from qualifying purchases. This means if you click on a link and make a purchase, I may receive a small commission—at no additional cost to you.