Not all bronies are created equal. Some are stacking cash and riding high on tech stocks and My Little Pony NFTs, while others are stuck trading Funko Pops for rent money. This is the brutally honest financial breakdown of two very different types of fans in the same pastel-colored fandom: the Rich Brony and the Poor Brony.

Let’s break down their habits, mindsets, and money moves.

🤑 Rich Brony: The Master of Passive Income

- Owns ETFs, Not Just Toys

Rich Brony isn’t just buying Rainbow Dash merch — he’s stacking shares of SCHD, VTI, and real estate ETFs. He lets his money work while he binge-watches Season 4. - Spends on Assets, Not Impulse Buys

Sure, he has a mint-condition Twilight Sparkle statue — but it came after maxing out his Roth IRA and buying a rental property in Florida. - Side Hustles with Style

Runs a monetized brony YouTube channel, resells collectibles, and flips NFTs for fun. All income is tracked, taxed, and reinvested. - Mindset:

“I’ll buy that $600 plush after I make $600 in dividends.”

Disclaimer: As an Amazon Associate, I earn from qualifying purchases. This means if you click on a link and make a purchase, I may receive a small commission—at no additional cost to you.

😵 Poor Brony: Drowning in Dusty DVDs and Debt

- Buys First, Thinks Later

Poor Brony drops $200 on an autographed Fluttershy poster… while interest on his credit card creeps toward 30%. Priorities? Nonexistent. - Confuses Rarity with Wealth

Thinks owning rare merch = being rich. Spoiler: it doesn’t pay the bills unless it’s listed, sold, and taxed correctly. - Hates the Stock Market

Calls it a scam while throwing $40/week into Dogecoin and sketchy mobile games with predatory microtransactions. - Mindset:

“If I just had more money, I’d be rich too.” (No, you’d just buy a life-size Pinkie Pie plush and still be broke.)

💰 Rich Brony’s Financial Setup:

- Brokerage: Fidelity or Vanguard

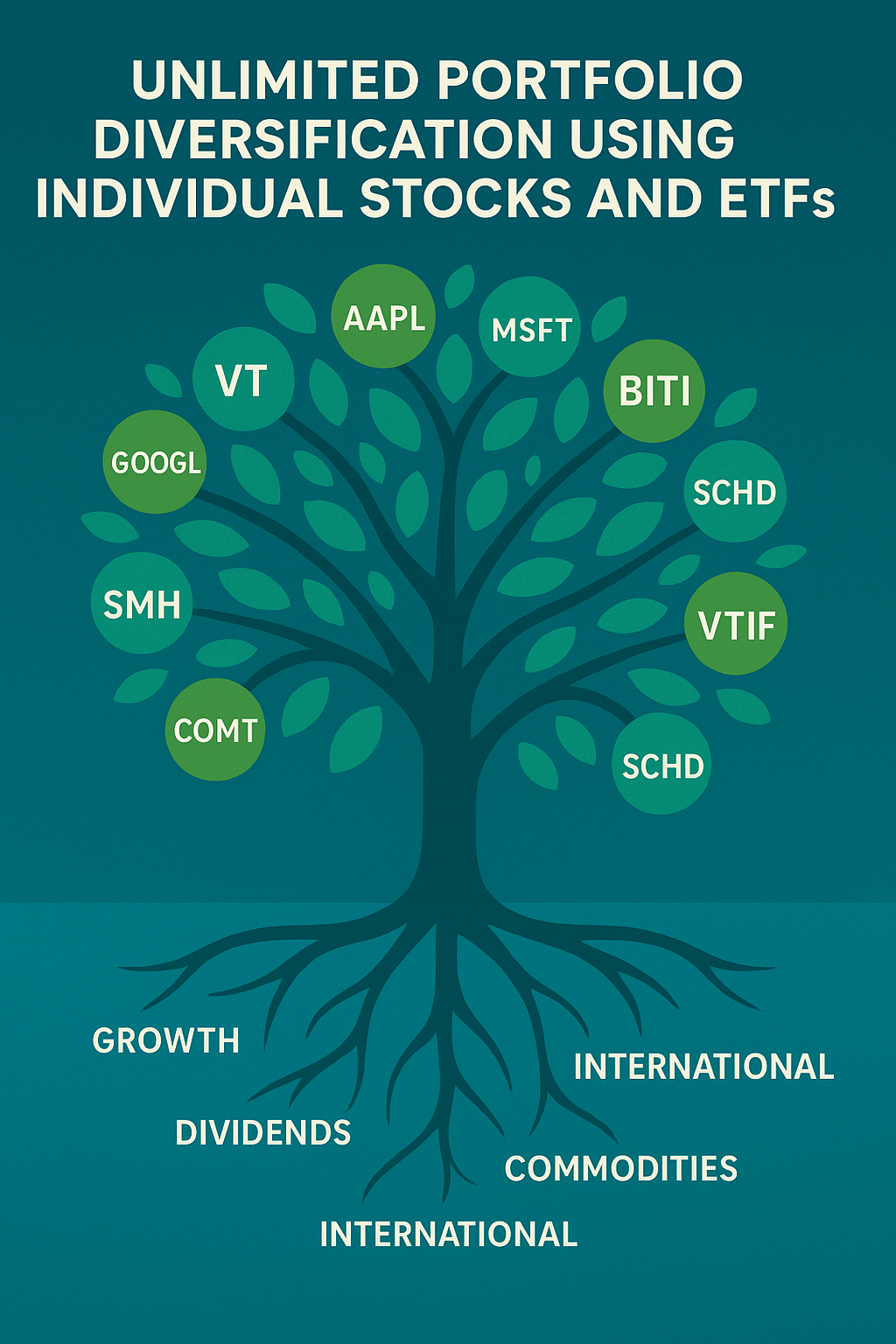

- Portfolio: 70% ETFs, 20% dividend stocks, 10% speculative bets

- Emergency Fund: Yes. Six months minimum.

- Income Streams: 3+

🚨 Poor Brony’s Setup:

- Brokerage: Robinhood (barely used)

- Portfolio: 100% FOMO

- Emergency Fund: What’s that?

- Income Streams: 1 (sometimes)

🧠 Final Thoughts:

Bronydom isn’t just a fandom — it’s a lifestyle. And just like in Equestria, not all ponies trot equally. Whether you’re galloping toward financial freedom or tripping over your own unpaid bills, it’s time to face the truth: being a Rich Brony isn’t about how many ponies you own — it’s about how much power you give your money.

Choose your path. Be the Brony with dividends, not debt.

Disclaimer:

This blog is intended for entertainment and educational purposes only. It is not financial advice. Always consult with a licensed financial advisor before making investment decisions — even if you’re a unicorn.

![Top 5 Security Suite Software Subscriptions to Protect Your Digital Life 27 Trend Micro Max Premium Security 10 User [Digital] [PC/Mac Downlo...](https://m.media-amazon.com/images/I/41VVucaXBeL.jpg)