So, You Touched the Crypto Turd

Let’s not sugarcoat it. If you’re elbow-deep in the crypto world right now, you’re basically playing in a digital sandbox full of shiny turds—and not the glittery, unicorn kind. I’m talking steaming piles of speculative assets masquerading as “revolutionary currency” that will supposedly free us from the evil clutches of central banks… someday.

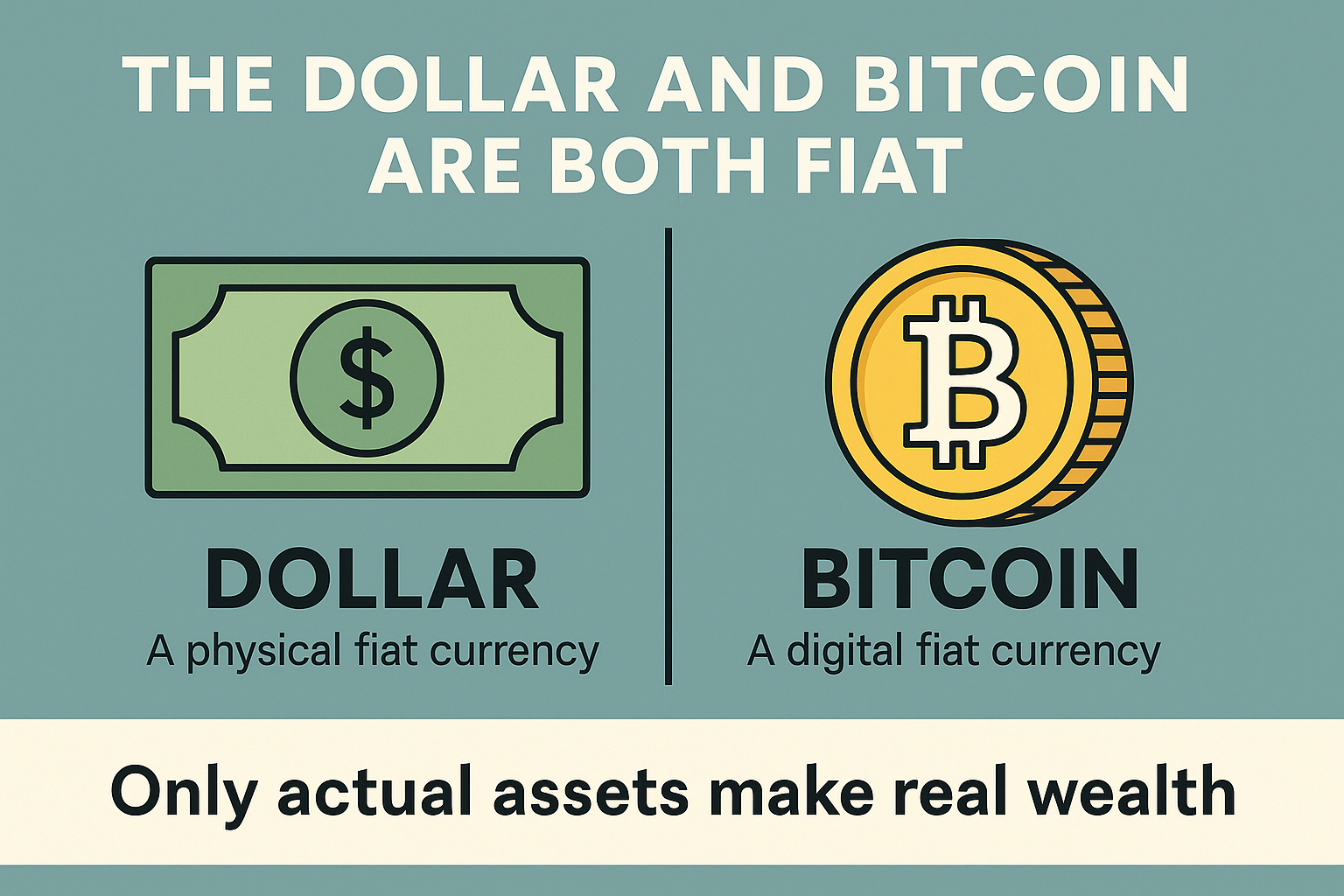

But here’s the truth: Crypto is fiat. And not even the stable kind. It’s imaginary monopoly money with a Discord server.

In this post, we’re diving headfirst into the digital manure pit to explore why cryptocurrencies are nothing more than speculative vehicles wrapped in hype, vapor, and moonboy tears.

Crypto Is Fiat — But With Extra Steps

Let’s define fiat real quick for the back row: it’s government-issued currency that isn’t backed by a physical commodity. Think U.S. dollars, euros, yen—stuff you can actually use to buy toilet paper or tacos.

Now enter crypto: a digital token created out of thin air, backed by… consensus and vibes. Bitcoin? Not backed by gold. Ethereum? Backed by the hope that you’ll one day use it to buy a digital monkey JPEG in the Metaverse. If fiat currency is make-believe validated by governments and armies, crypto is make-believe validated by Twitter threads and tech bros.

At least fiat lets you pay taxes. Crypto? You’ll owe taxes when you sell it. The IRS wants real dollars, not Satoshi coins from your cold wallet, Chad.

Disclaimer: As an Amazon Associate, I earn from qualifying purchases. This means if you click on a link and make a purchase, I may receive a small commission—at no additional cost to you.

But What About Scarcity, Bro?

Yes, Bitcoin is “limited to 21 million coins.” So what? You know what else is limited? Beanie Babies. And we all know how that ended. Hint: Princess Diana Bear is worth less than the printer paper it’s stuffed with.

Scarcity only matters when there’s real-world demand. Gold is scarce and used in everything from wedding rings to microchips. Bitcoin is scarce and used to pay ransomware attackers. One of these has utility. The other has a Reddit forum.

Blockchain: A Fancy Word for Slow Spreadsheet

Ah yes, blockchain—the magical buzzword that makes every crypto pitch sound smarter than it is. It’s like saying “quantum” in a Marvel movie. Nobody knows what it means, but it sounds cool.

In reality, blockchain is a public ledger—a database. But slower. Less efficient. And designed to use more electricity than the nation of Finland. All that just so I can send you 0.0003 DOGE for your used socks on the blockchain?

We already have Venmo, Zelle, and PayPal. And those don’t swing 40% in value during a bathroom break.

The Speculative Ponzi Fiesta

The only reason anyone buys crypto is the hope that someone dumber will buy it for more. That’s not investing. That’s a speculative pyramid scheme with more hashtags. #HODL #ToTheMoon #NowICantPayRent

In a traditional stock, you’re buying ownership in a company that makes actual products, earns real revenue, and (if you’re lucky) pays you dividends. In crypto? You’re buying a hope coupon. A promise that someone—usually a 19-year-old in a Discord server—will take it off your hands later for a higher price.

Spoiler alert: They won’t.

Stablecoins: The Fiat-Denial Fiat

“Not all crypto is speculative! What about stablecoins?”

Buddy. Tether is pegged to the U.S. dollar. So it’s… fiat. Just digitized, unregulated, and backed by mystery reserves that may or may not exist in a sketchy offshore bank run by a guy named “CryptoLarry.”

If your “innovation” is recreating fiat but making it less stable, less transparent, and more scammy—congratulations, you’ve missed the point entirely.

The Celebrity Pump-And-Dump Olympics

When your currency needs Paris Hilton, Jake Paul, and that guy from “Shark Tank” to survive, you’re not in a financial revolution—you’re in a circus.

Crypto thrives on hype, not fundamentals. That’s why every major bull run has been followed by a crypto winter colder than your ex’s heart. Because eventually, the music stops and people realize they just bought a JPEG of a pixelated rock for $600,000 and can’t return it.

NFTs: You’re Buying a Link, Not the Art

Let’s talk about NFTs while we’re on the subject of bad ideas wrapped in blockchain. NFTs are like buying a certificate saying you “own” a digital image… which still lives on a server that could disappear tomorrow.

It’s like paying $2 million for a house deed written in crayon that says you own a cloud.

Spoiler: you don’t.

The Environmental Disaster Nobody Talks About

Bitcoin mining uses enough electricity to power small countries. All to keep a digital ledger running so people can trade cartoon dog tokens. Elon Musk tweets about environmentalism while pumping Dogecoin like it’s a carnival prize.

It’s like driving a Hummer to a climate protest. You can’t call this a sustainable future while you’re roasting polar bears for every transaction.

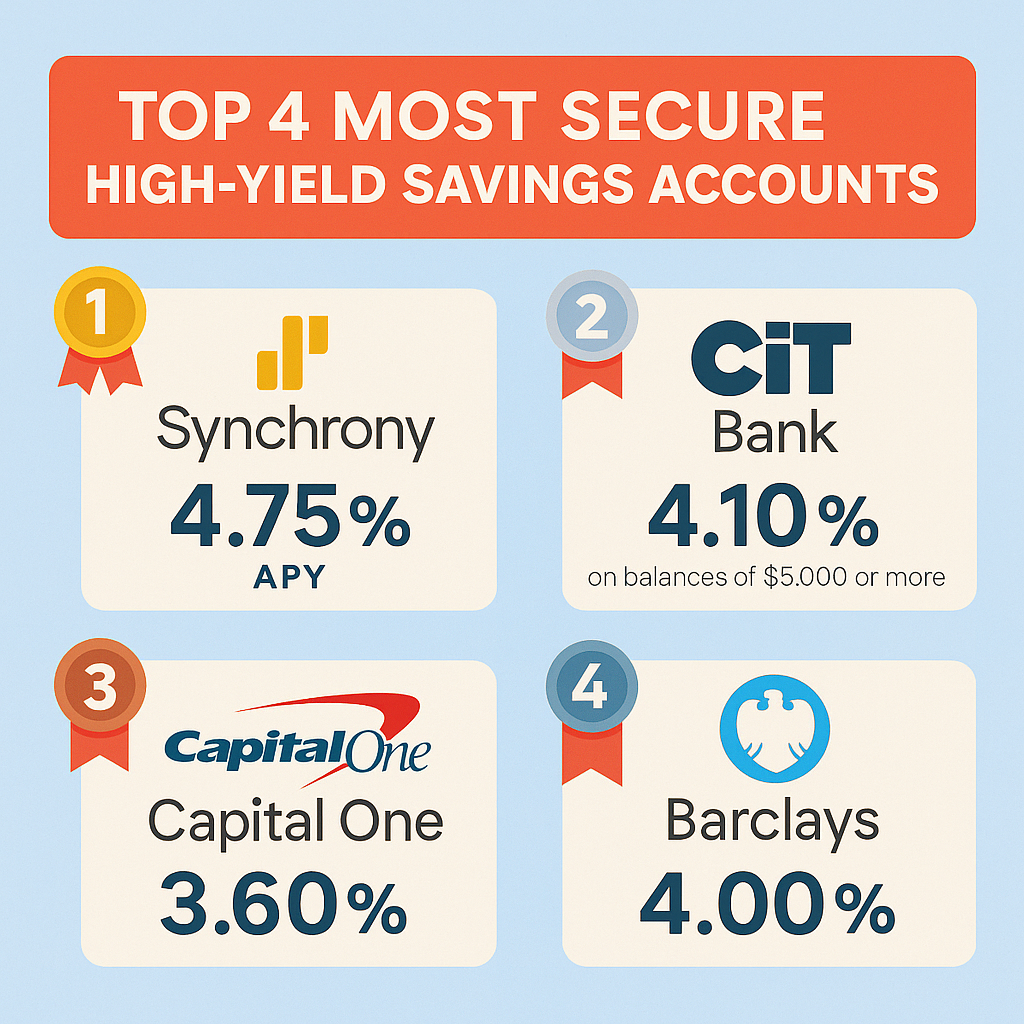

Real Assets vs. Imaginary Friends

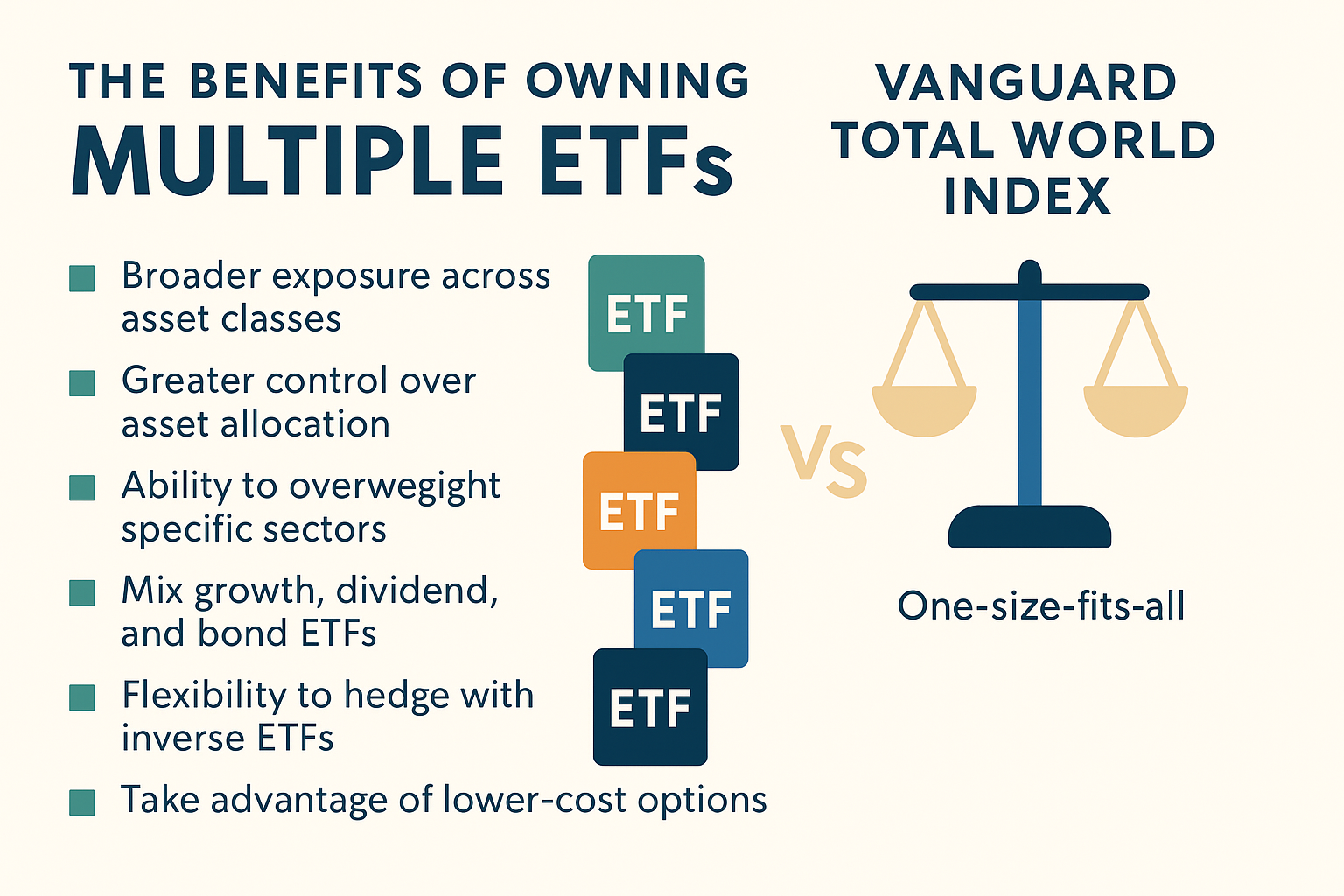

If you want to build wealth, invest in things that produce value: companies, real estate, index funds. You know—stuff that’s tied to the real economy.

Crypto isn’t tied to anything. It doesn’t pay dividends. It doesn’t generate cash flow. It doesn’t make burgers or iPhones or sell ads. It’s pure narrative.

You might as well buy lottery tickets with better memes.

Conclusion: Wash Your Hands, You Touched a Turd

Let’s recap:

- Crypto is fiat. Just worse.

- It’s pure speculation, not investment.

- It’s backed by hope, hype, and hashtags.

- Blockchain isn’t the messiah—it’s a laggy spreadsheet.

- Your “decentralized future” is already being re-centralized by exchanges, wallets, and billionaire influencers.

If you’re holding crypto right now, do yourself a favor: go wash your hands. You’ve been touching shiny, digital turds—and someone convinced you they were gold bars.

The real flex? Owning assets that actually do something.